Aligning with Regulations, Market Trends, and Technological Advancements for Effective Carbon Credit Trading

Harnessing and enabling transactions in carbon markets involves creating a platform or framework that enables efficient carbon credit trading. We are constantly contributing and aligning to:

Various regulatory frameworks

Market dynamics

Technological innovations to facilitate carbon offset transactions

India serves as a strategic carbon trading hub due to its favourable policies, rapidly growing renewable energy market, and hols position as a key player in the developing world. We have initiated and are focusing on:

Carbon Offsetting Projects:

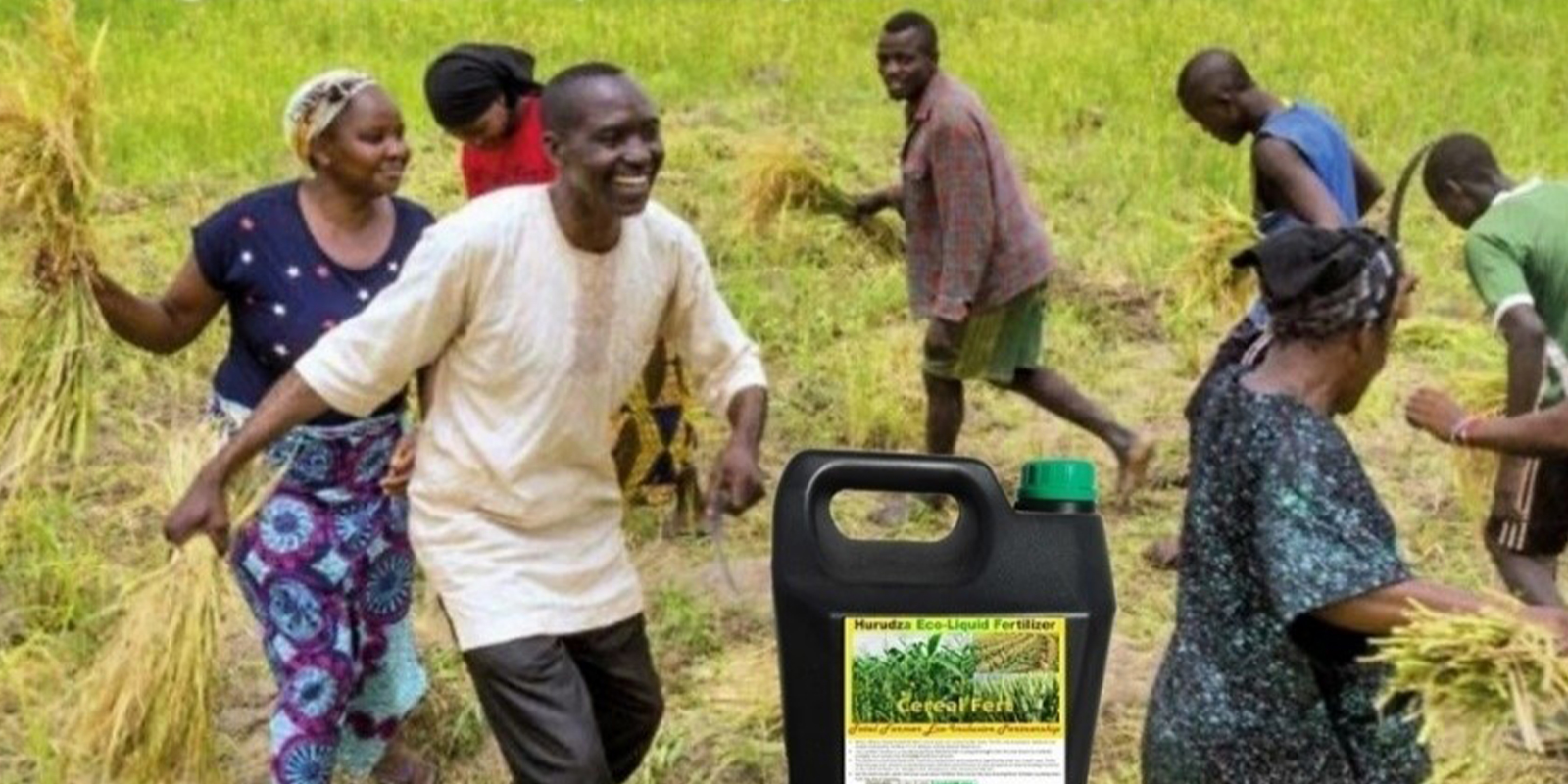

Managing/Facilitating projects, which allows offsetting/harnessing carbon credits, such as reforestation, renewable energy, or energy efficiency.Market Infrastructure:

Setting up a marketplace that connects India Africa and other European companies and governments with carbon credits.Cross-border Trade Mechanisms:

Creating efficient mechanisms for cross-border transactions of carbon credits, aligned, which governs international carbon markets.Digital Platforms for Market Efficiency:

Building a robust digital trading platform that allows companies and nations to buy and sell carbon credits easily, with clear reporting and verification processes.With continuously evolving regulatory requirements, we are continuously building the platforms for knowledge creation and dissemination. The agile technology and platform, offering knowledge, standardisation, ease of verification, validation and transaction management. Our ecosystem allows us to manage & adhere to the entire lifecycle.

Standardization of Carbon Credits:

Ensuring credits generated in Africa or India as recognized by European standards.Verification Mechanisms:

Implementing verification and validation systems that are internationally recognized such as the United Nations Framework Convention on Climate Change (UNFCCC).Right financing tools, that allow the opportunities in building green initiatives to offset and generate long term carbon generation opportunities.

Green Finance Opportunities::

India, in collaboration with African and European financial institutions, holds potential to tap into green finance, promoting the growth of carbon-offsetting projects through investments in clean technologies, sustainable agriculture, and forestry.Public-Private Partnerships (PPP):

By creating a sustainable, transparent, and scalable carbon market hub in India that serves African and European countries, our framework could unlock economic opportunities while driving global emissions reduction efforts.